Welcome to Joseph Bernard Investment Real Estate!

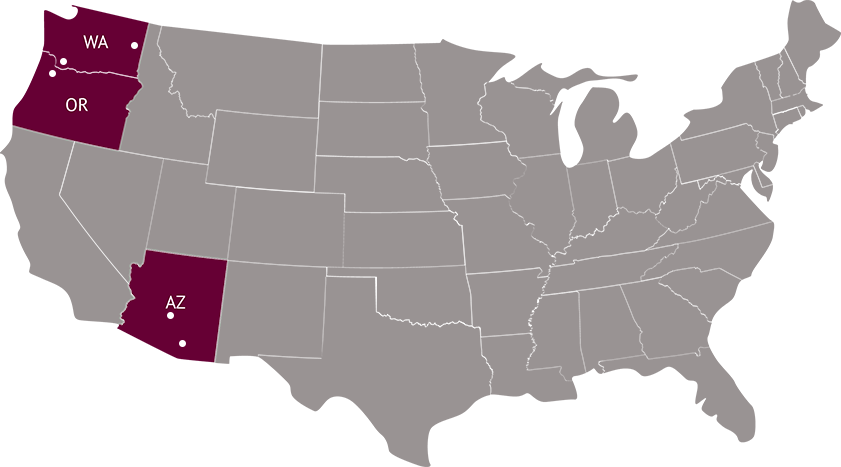

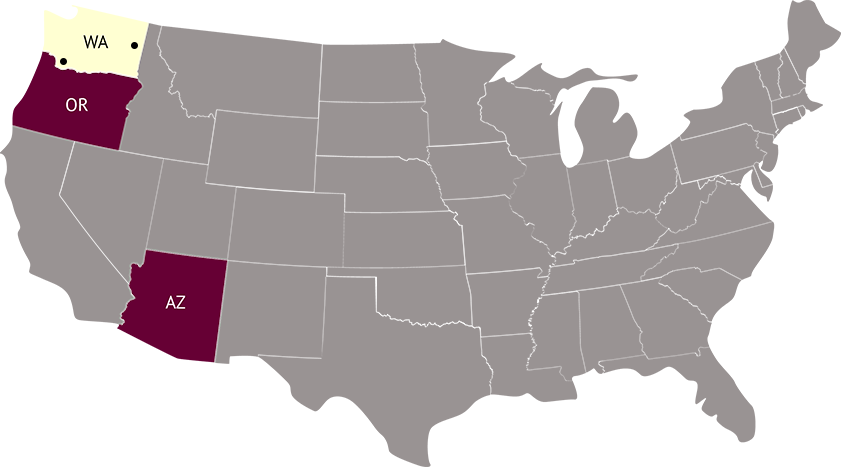

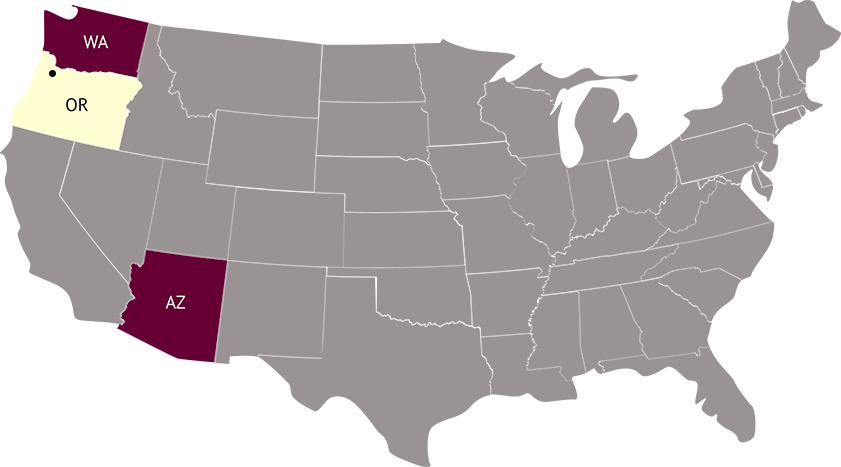

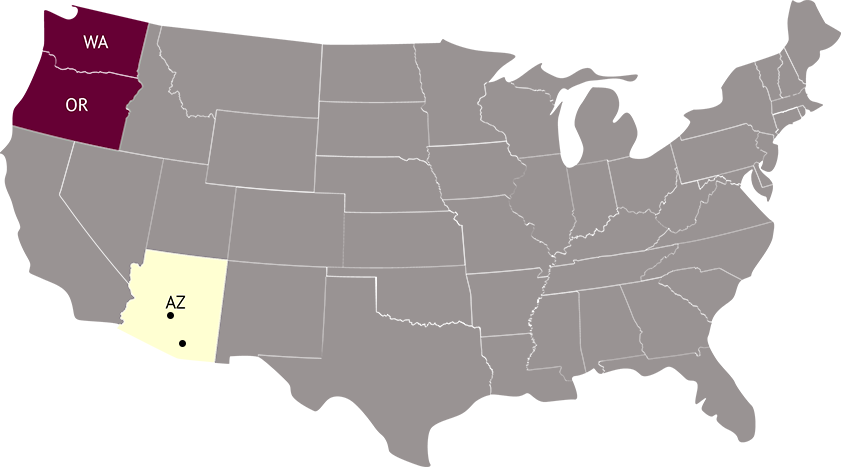

Joseph Bernard Investment Real Estate is a leading multifamily brokerage firm with offices in Oregon, Washington, and Arizona. In 2005, our company was founded to provide superior apartment brokerage services by focusing on professionalism, integrity, and customer service.

Today these three principals stand as our foundation, enabling us to deliver high quality brokerage services, wealth building, and asset management to the market. Essentially filling the void in the marketplace by providing quality apartment investment resources.

Over the last decade, we have outperformed most of our competitors and have been named one of the Fastest Growing Private Companies in the USA, earning the Inc. 5000 award twice. Our successful model and extensive market knowledge have enabled us to expand into more markets and quickly become a leader within the apartment brokerage communities.

Whether you are a buyer or seller, working with the right broker is the most important decision you can make. This decision has a direct impact on the current and future success of your portfolio. We help you succeed with your investment goals by avoiding the pitfalls and other difficulties you may face on your own or with the wrong broker. We encourage you to experience the difference in apartment brokerage with the quality of service you deserve. We look forward to serving you and have confidence that you will be fully satisfied with our firm.

Sincerely,

Joseph Chaplik, President

LOOKING FOR PROPERTY?

.jpg)